Are you developing, planning or running an innovative business? Be aware of the legal and tax challenges involved.

We believe that innovation processes happen in every business! You are constantly striving to develop your business and create attractive products and services. This inevitably leads to innovation. Therefore, you may need the help of experts in the field to properly identify, classify and manage the tax and legal implications of innovative activities.

How can we help?

It is worth reviewing the legal and tax aspects that will protect your business at each stage of its innovative activity (creation, R&D work, commercialisation, development, transfer or licensing of intellectual property rights). We have summarised below the main legal and tax areas to be analysed and for which we provide assistance.

-

Creating and developing intangible assets

-

Change in the existing settlement model

-

Group reorganization involving the transfer of an innovative business (or its part)

-

Tax Reliefs for companies and staff

-

Purchase / Sale of an innovative business to/from a third party

-

Legal and tax employee matters and optimal forms of cooperation

| How can we help? | Benefits |

|

|

| How can we help? | Benefits |

|

|

| Transfer Pricing |

|

| How can we help? | Benefits |

|

|

| Transfer Pricing |

|

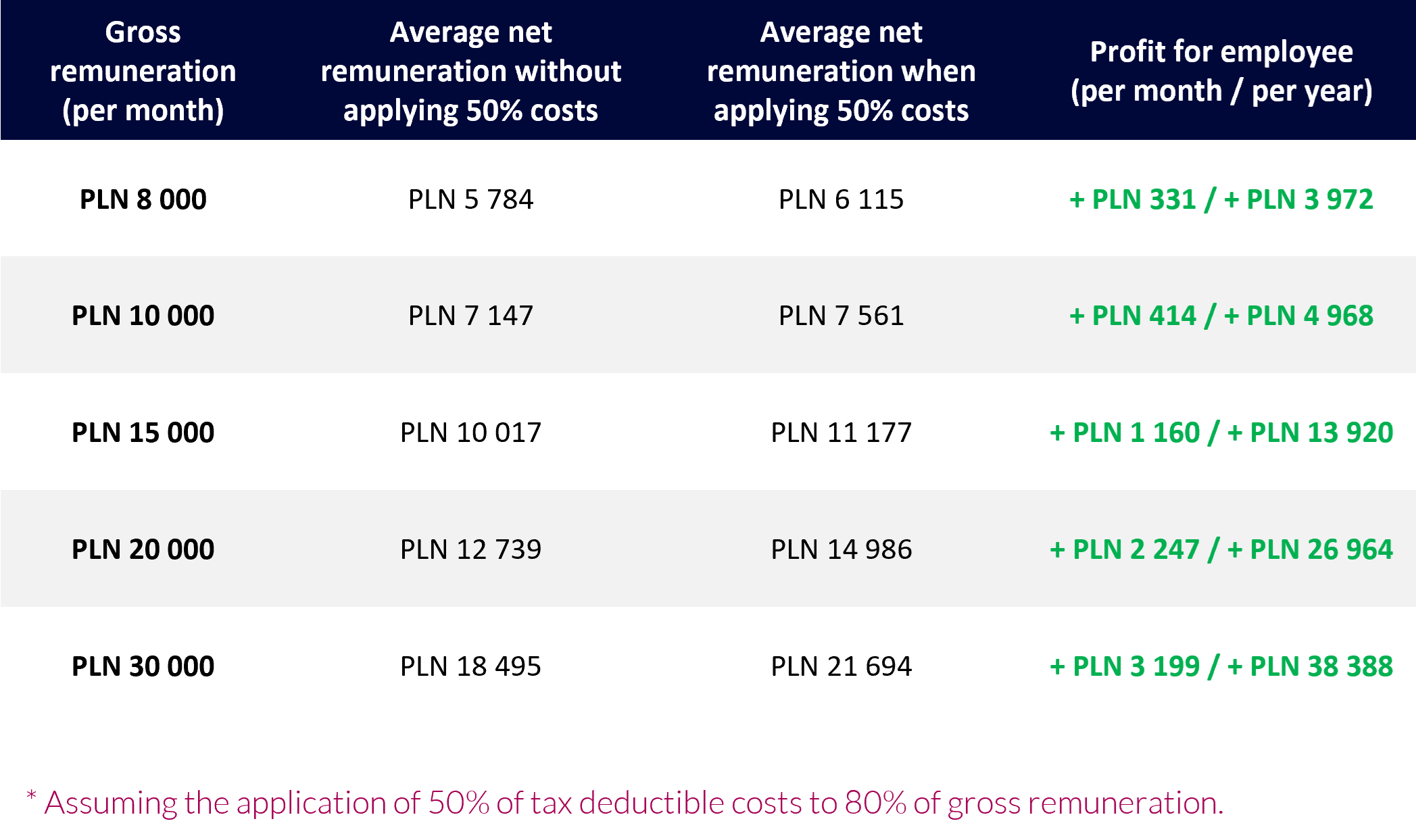

Implementing 50% tax deductible costs

| How can we help? | Benefits |

|

|

Research and development relief

| How can we help? | Benefits |

|

|

Polish Investment Zone

| How can we help? | Benefits |

|

|

Purchase

| How can we help? | Benefits |

|

|

Sale

| How can we help? | Benefits |

|

|

| How can we help? | Benefits |

|

|

Feel free to contact us

Bartosz Głowacki

Partner I Tax adviser E: bartosz.glowacki@mddp.pl T: (+48) 603 980 382

Agnieszka Krzyżaniak

Partner E: agnieszka.krzyzaniak@mddp.pl T: (+48) (22) 322 68 88

Bartosz Doroszuk

Partner | Tax adviser E: bartosz.doroszuk@mddp.pl T: (+48) 790 732 266

Dorian Jabłoński

Senior Consultant E: dorian.jablonski@mddp.pl T: (+48) 504 400 031