- Home

- Expertise

- Solutions

- Accounting for investments

- Automation of the IFT-2R form

- Cooperation in the form of B2B

- E-commerce

- Fiscal Representation

- VAT Group

- Hybrid mismatches

- Intangible Assets

- Investment Funds and Institutional Investors

- MDDP for Earth | Green Taxes

- Qualitative transfer pricing analyses (benchmarking)

- Partially paid benefits

- Plastic levies

- Remote work from abroad

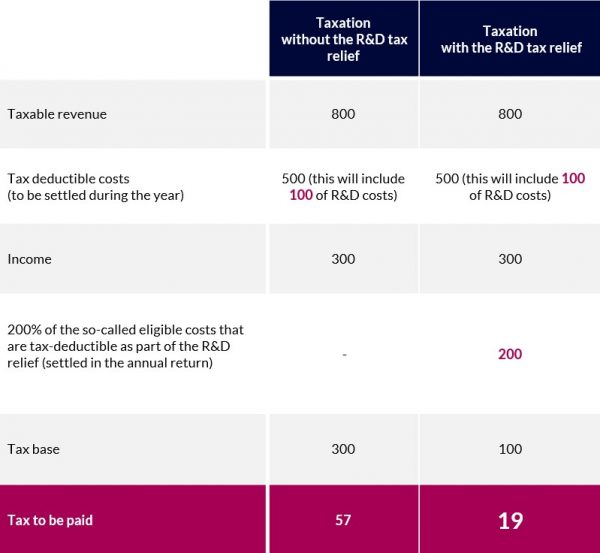

- R&D tax relief for green innovations

- Reporting tax schemes (MDR)

- The latest SLIM VAT 2 package

- SMART.TP app

- SMART.TP-R app

- Tax strategies

- Transactions with tax havens

- VAT Compliance for customs agencies

- Tax changes 2022 – The Polish Deal

- Withholding Tax (WHT)

- Sectors

- Team

- Knowledge hub