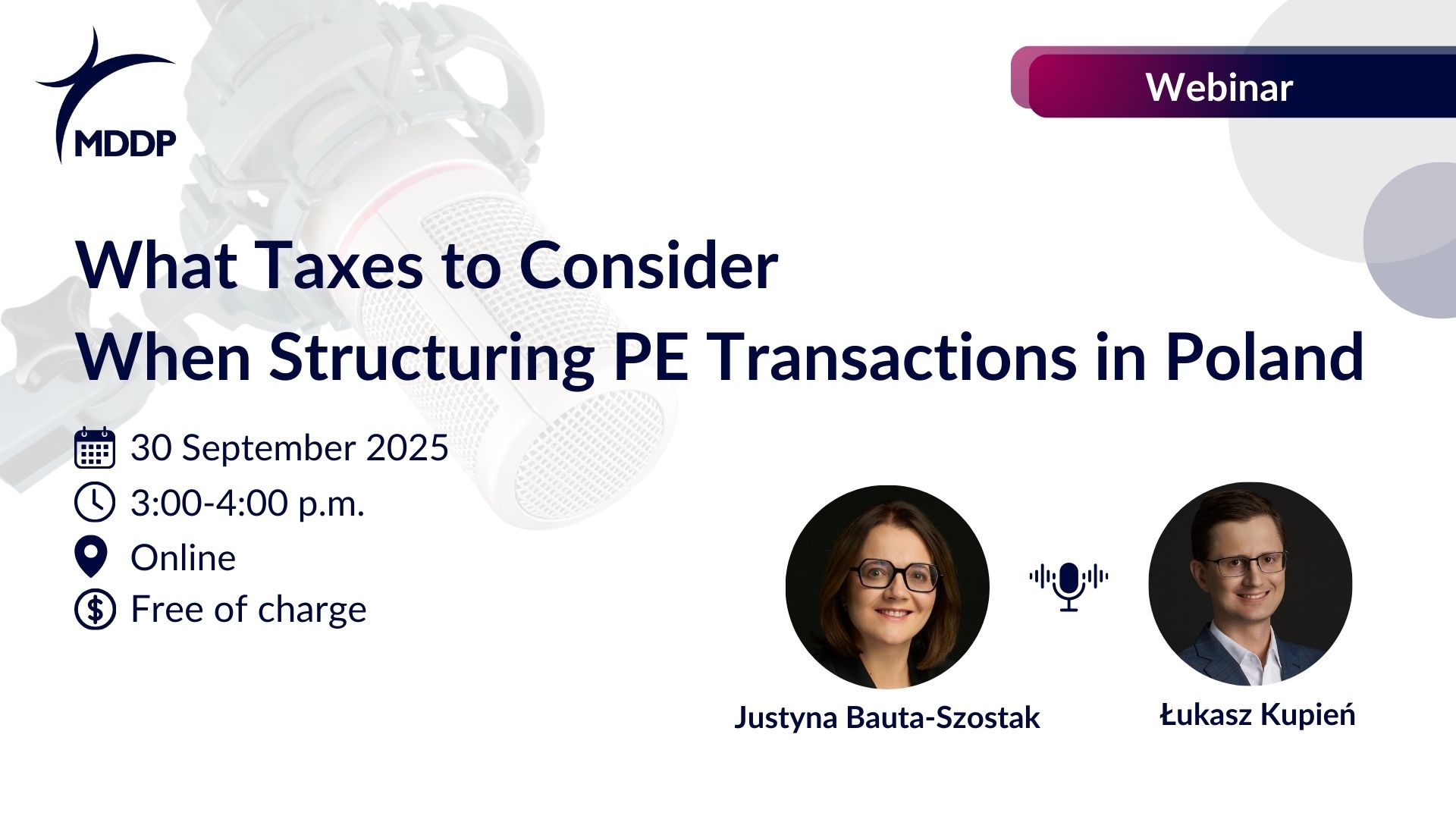

What Taxes to Consider When Structuring PE Transactions in Poland

September 30, 2025 at 3 p.m.

Taxation plays a pivotal role in designing private equity transactions. It impacts both operational performance and the eventual returns at exit.

The rapidly evolving landscape of tax law in Poland offers a wide range of opportunities and challenges for investors. Recent developments in withholding taxation (WHT), changes to tax treaties, and preferential regimes for Polish holding companies present a range of possibilities, each with distinct advantages and potential drawbacks. In addition, case law developments and upcoming legislative changes, are reshaping the tax environment for foreign investment funds and REITs investing in Poland.

In this webinar, we will dive in these developments and explore how they intersect with the unique needs of foreign investors.

We will explore the key taxes to consider both during operations and at exit of these structures:

- Basic Structure – Foreign Holding & Polish LLC

- Polish Holdings (Polish Holding Regime, Alternative Investment Company)

- Polish Branch of a Foreign LLC

- Closed-End Investment Fund Structure

- Foreign Investment Funds & REITs: Case Law and Upcoming Changes in Law

- Indirect Taxation at Entry and Exit – VAT and CLAT

- New exemption for investment funds proposed by the Polish Ministry of Finance

CEO, CFOs, tax managers, financial controllers,

chief accountants,

employees of finance and accounting departments,

persons in tax, legal and financial departments,

compliance officers and

representatives of companies making cross-border investments

We will briefly and substantively discuss the business opportunities and risks related to key topics for funds concerning investments in Poland.

30 September 2025 | 3:00-4:00 pm

online

Free of charge

Webinar will be held in English

Justyna Bauta-Szostak

Partner | Tax adviser | Attorney at Law

Email: justyna.bauta-szostak@mddp.pl

Tel.: +48 502 241 631

Łukasz Kupień

Partner | Tax adviser

Email: lukasz.kupien@mddp.pl

Tel.: +48 792 999 105

The ever-changing tax environment requires investors to be vigilant in this area from the very first stage of investment implementation. Our experts provide comprehensive tax advisory services for investment funds, private equity funds, venture capital, as well as companies that are the subject of investment (the “target”).

We offer comprehensive tax advice including transactional advice, post-trade advice and withholding tax support (including: so-called Focus Claims / Aberdeen Claims). MDDP’s Tax Advisory team works closely with Osborne Clarke’s legal, MDDP Corporate Finance and the best accounting firms. Our support ranges from local to international with working with leading European and global advisory firms and law firms.